3 major, very well-funded groups and 2 minor underfunded groups are pushing concepts on how to solve America’s economic problems and ‘Fiscal Cliff.’

The 3 major well-funded groups are the Peter G Peterson Foundation and David M. Walker,

The Modern Money Theory  and The Ludwig von Mises Institute and its followers.

and The Ludwig von Mises Institute and its followers.

These major well-funded groups disagree on many things. But, they all believe the commonly held economic conclusion that money can only be monetized debt (Debt based) and exist not as a medium of exchange but only as a standard of deferred payment where someone must always owe, be obligated or in servitude to someone else.

These major well-funded groups disagree on many things. But, they all believe the commonly held economic conclusion that money can only be monetized debt (Debt based) and exist not as a medium of exchange but only as a standard of deferred payment where someone must always owe, be obligated or in servitude to someone else.

The minor underfunded groups are The American Monetary Institute  and debtfreemoney.org.

and debtfreemoney.org.

The American Monetary Institute and proponents of the Chicago Plan believe that money should be created as both monetized debt and monetized wealth.

DebtFreeMoney.org believes that money should only be created as monetized wealth (Wealth based).

Peter G. Peterson Foundation, David M. Walker and their followers believe that the only way to solve the economic problems is to cut spending and cut programs. The Modern Money Theory believes that debt has no consequences and you can borrow yourself into prosperity. Von Mises followers believe that government is bad, that any kind of money except gold is bad and that gold and the free market will solve everything.

Most of these believe that the 12 Federal Reserve banks are part of the U.S. Government. Byron Dale and Gregory K. Soderberg know for a fact that this is not true. They sued the Fed Reserve Bank of Minneapolis in small claims court. When they filed their claim they were told that they could not file the claim because the Federal Reserve Bank of Minneapolis was part of the government and one can’t sue the government. They told the clerk, “We understand that one can’t sue the government but we believe the Federal Reserve Bank of Minneapolis is a private bank. However, we don’t want to argue with you. If you will be kind enough to file the case, if we’re wrong and they send it back saying it can’t be filed, we will come back and pick up our papers. If we’re right, they will file the case and set a hearing date.” They were right. A date was set. A Federal Reserve attorney showed up and testified that the Federal Reserve banks are privately owned banks.

Byron Dale and Gregory K. Soderberg know for a fact that this is not true. They sued the Fed Reserve Bank of Minneapolis in small claims court. When they filed their claim they were told that they could not file the claim because the Federal Reserve Bank of Minneapolis was part of the government and one can’t sue the government. They told the clerk, “We understand that one can’t sue the government but we believe the Federal Reserve Bank of Minneapolis is a private bank. However, we don’t want to argue with you. If you will be kind enough to file the case, if we’re wrong and they send it back saying it can’t be filed, we will come back and pick up our papers. If we’re right, they will file the case and set a hearing date.” They were right. A date was set. A Federal Reserve attorney showed up and testified that the Federal Reserve banks are privately owned banks.

Except for DebtFreeMoney.org, all the above mentioned interests have these other things in common. They never address the truth that:

- the effects of interest in a monetized debt-based economy produces economic servitude

- that their economic training never exposed them to the fact that American law in 1792 provided for a debt-free medium of exchange

- that over 80 years, through the efforts of well-funded special interests, our money was switched from an evidence of debt-free wealth to an evidence of unpayable interest-bearing debts.

- Forcing Americans and their government into debt to obtain a medium of exchange is SERVITUDE!

Greg and Byron have both written to the U.S. Treasury asking how money is created in the United States.  The Treasury answered, “The actual creation of money always involves an extension of credit by private commercial banks.” John B. Hendrickson Specialist in Price Economics Congressional Research Service and Library of Congress stated: “Money is created when loans are issued and debts incurred; money is extinguished when loans are repaid.” Anyone who has ever borrowed from a bank knows that when interest is added to your loan your debt has grown but your money supply has not. They wrote back asking, “If all money is created as interest-bearing loans how is the money created to pay the interest on the loans?” The Treasury answered: “The money that one borrower uses to pay interest on a loan has been created somewhere else in the economy by another loan.”

The Treasury answered, “The actual creation of money always involves an extension of credit by private commercial banks.” John B. Hendrickson Specialist in Price Economics Congressional Research Service and Library of Congress stated: “Money is created when loans are issued and debts incurred; money is extinguished when loans are repaid.” Anyone who has ever borrowed from a bank knows that when interest is added to your loan your debt has grown but your money supply has not. They wrote back asking, “If all money is created as interest-bearing loans how is the money created to pay the interest on the loans?” The Treasury answered: “The money that one borrower uses to pay interest on a loan has been created somewhere else in the economy by another loan.”

Why ‘Saving’ is so difficult. It is impossible for everyone to save when every dollar is created as interest-bearing debt. It is impossible for anybody to save without jeopardizing someone else. Let’s look at the math. Someone gets a loan of one hundred dollars at 10% interest. As soon the 10% interest is added the debt increases to $110 debt but the loan only increased the money supply by $100. If $10 is taken out of circulation and put into savings, the increase in the money supply drops from $100 to $90 but the increase in the debt is still $110. Collectively, multiple savers just make the debt problem worse.

Anyone with a lick of common sense can see that when a debt is larger than the money supply and the supply of money cannot be increased without creating more debt, you can’t get out of debt unless the debt is declared unlawful and wiped off the books. That’s where America is today.

It is now the solemn responsibility of Congress to reverse their error and return America to a debt-free wealth-based money system.

America’s ‘Economic Fix’ is 2-pronged.

1. “SPEND ‘Em! Don’t LEND ‘EM!” Spend new money into circulation without debt or interest. The path to do so rests in the Intent and in Article 1 Section 8 of the United States Constitution.

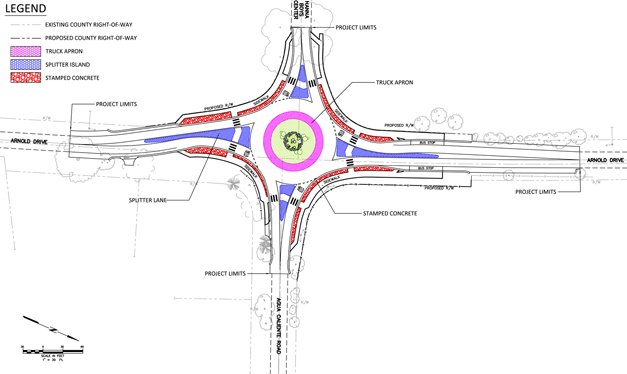

The Preamble says to “…promote the general Welfare. Article 1 Section 8 says Congress shall coin Money and established post Roads. Congress should combine these into one act that monetizes the value of building, upgrading and maintaining our public roads, creates the numbers and spends them into circulation debt-free in lieu of taxation or bonding as a payment earned as wages by the people who do the producing (work) that benefits the general public. The money supply increases with productivity gains.

The transportation system will be built under the same process it is now. The people themselves at the local level, not Congressman, decide how and where the transportation system needs to be built, repaired, upgraded and maintained to best serve the people’s needs. This shall be done by the people living in the jurisdiction of local governments (township, city, county or state). Local government can do it by themselves or work with state government to hire engineers needed to design the project. Bids will be let the same as they are now. The private contractor meeting the bid specifications with the lowest and best bid will get the job. A copy of the bid will be sent to the Comptroller of the currency requesting that new money be created for the bid amount and delivered to the local project authority for spending to pay salaries of laborers and material providers who will also spend the money into the economy. The Comptroller’s only oversight will be to make sure the project and contractors are real and the jobs are completed to bid specifications.

This process meets the Spirit and Intent of the Constitution, provides the necessary relief without any harmful disruption to our national economy, benefits almost everyone equally and affords special privileges to none.

The control and issuance of our medium of exchange as interest-bearing debts has resulted in incomprehensible debt, loss of private property, economic contention and chaos. As much as possible of the great quantity of real and personal property that fractional reserve banking has stolen from American citizens must be returned to the victims.

2. Write off most of the unlawful debt. We need to start with SECTION 31 of the Federal Reserve Act which clearly states, “the right to amend, alter, or repeal this Act is expressly reserved.”

“Federal Reserve notes are liabilities of the Federal Reserve Bank and obligations of the United States government and a first lien on all assets of the Federal Reserve banks and the collateral held against them.  Congress has specified that Federal Reserve banks must hold collateral equal in value to the Federal Reserve notes that the bank receives so that if the Federal Reserve System were ever dissolved, the United States would take over the notes and the assets of the 12 Federal Reserve banks.” *Source: personal letter to Byron Dale from the United States Treasury.

Congress has specified that Federal Reserve banks must hold collateral equal in value to the Federal Reserve notes that the bank receives so that if the Federal Reserve System were ever dissolved, the United States would take over the notes and the assets of the 12 Federal Reserve banks.” *Source: personal letter to Byron Dale from the United States Treasury.

All Federal Reserve notes should be removed from circulation and replaced with United States currency. The new currency would look similar to the old currency but with the words “Federal Reserve note”, the bank’s seal and words “this note is a legal tender at its face value for all debts public and private” taken off it face.

Section 5101 of title 31, United States codified law is amended by adding United States money issued as monetized wealth. Through the use of a decimal accounting system, it will be issued in currency, coin and including electronic transfer.

Section 5103 of title 31, United States codified law shall be amended to read, “United States coins, currency including electronic transfer are legal tender for all monetary exchanges.”

Most debt must be and needs to be repudiated. All securities, notes, bonds, etc. of all federal, state and local governments held by the Fractional Reserve Banking System before the Federal Reserve Act was repealed shall be cancelled off the books of the government, but the money created by these loans shall remain in circulation.

All debts of people earning under $250,000 a year that is owed to the government or any Fractional Reserve lending institution shall to be cancelled out of existence. The money created by these loans shall remain in circulation.

All people with earnings over $250,000 a year shall turn their books over to the General Accounting office of the United States government for audit to determine if they are honest lawful businesses or just friends and front money powers (the biggest banks). If they are found to be lawful and honest they shall be allowed about their business. If they are run by friends and or friends of the money powers, their assets should be stripped from them and returned to the people just as assets were stripped from Mr. Madoff when he was found guilty of running a Ponzi scheme.

All corporations shall be broken up and reorganized as small independent, employee-owned operated businesses.

Private commercial banks (including the credit card industry) will be stopped from monetizing the wealth of the people as debts to the people and government and assets to the banking system.

Fractional Reserve Banking shall be acknowledged for the Ponzi scheme that it is, declared unlawful and slowly shut down. To do this, the reserve rate shall be raised 2% monthly to phase out the practice. During that 4-year time, all banks should slowly be closed and check-clearing functions of the banking system transferred into the postal service.

Except for junk mail, Check-clearing and present services of the post offices will be funded with newly created debt-free money.

Except for junk mail, Check-clearing and present services of the post offices will be funded with newly created debt-free money.

In the process of closing and shutting down, private commercial banks shall be audited. Foreclosed on property like all the farms that were foreclosed on when the banks raised interest in the 1980s and other years including all the homes that were foreclosed on should be returned to their original lawful owners if possible.

All stock and futures exchanges shall be outlawed and shut down as they are nothing more than extensions of unlawful corporate Ponzi schemes and rigged gambling houses.

As the money supply is so low, new money may need to be spent into circulation temporarily for other things that promote the general welfare like Social Security etc.

Our present suffering will only increase in its severity if we refuse to see the truth and correct our mistakes. By acknowledging these mistakes and making appropriate changes, we will avoid deepening economic servitude, hardship, suffering, destruction and unnecessary austerity measures otherwise sure to come and have the promise and prospect of Freedom, Prosperity and Future worth living.

We should not expect to find economic solutions from well-funded groups like the Peter G Peterson Foundation and David M. Walker, The Modern Money Theory and the Ludwig von Mises Institute whose ideas, concepts, and misinformation have served special interests, not the general welfare and produced the economy we have today.

Gregory K. Soderberg & Byron C. Dale www.debtfreemoney.org