Before explaining the ‘mathematical flaw’, let me explain the most important flaw that most people miss. That flaw is that, ‘forcing people to incurr debt to obtain a medium of exchange creates economic servitude-slavery.’ It doesn’t matter if we are charged interest or not or if the interest is payable or not. There can be no Freedom without Economic Freedom.

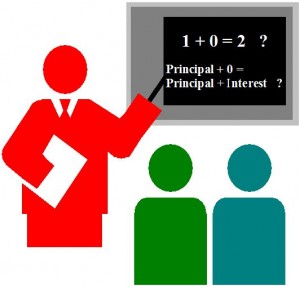

Economists, bankers and most government leaders choose not to discuss a very significant mathematical flaw in our present money system. The flaw is that under our present money system all money is created by the banking system and put into circulation as interest-bearing loans. This process makes it mathematically impossible to repay the loaned principal plus the incurred interest because when all the money is created as loans, only the principal is created-never the interest. There is simply no way to create the additional money needed to pay the interest incurred by the loan. Money does not grow. Only the principal is created by the loan. The principal is uncreated when it is repaid. When the interest comes due, the debt becomes greater than the money supply! A SHORTAGE OF MONEY IS CREATED THAT CONSTANTLY GROWS.

Time and Interest always makes the debt grow but neither makes the money supply grow! Money does not grow. The money supply only increases with more loan creation. This ‘SHORTFALL’ between the money created and the debt owed creates a constant and growing spread between the prices of raw products and the prices of finished products. It causes ever-growing pressure to reduce the cost of wages paid to workers. Interest is always a cost of doing business. It must be paid or the bank forecloses on the loan and takes your business away from you. Therefore the cost of interest must be added to the price of finished goods, or you must find a way to cut your wage expenses or the cost of your raw materials. This ‘SHORTFALL’ is the reason that we have ever growing debts by government, business and individuals even though everything is produced as an asset.

This shortfall is not a sign of bad management; it is simply mathematically impossible to pay both the principal and the interest, because under our present money system there is no way to create the money need to pay the interest. That is why the total debt constantly grows. The interest can only be paid with property through foreclosure.

Adfditionally, one cannot pay a debt with another debt and get rid of the debt. I cannot pay one loan with another loan and get rid of the debt.

HOW DOES THIS AFFECT YOUR LIFE

Our current money system affects us in very subtle but negative ways. It deceives us into living a life of illusion. We are taught that we must all gain a monetary profit from our business and our labor and that we must save some of that monetary profit for the future or invest it to earn more monetary profit. It’s obvious from the facts that everything is produced as wealth, yet in producing all wealth we are more than $59 trillion in monetary debt! That makes it impossible to collectively have a monetary profit and savings.

Imagine that we start with no money. 10 people borrow $100 each creating a total money supply of $1000. How can each save $10 and pay back $110 each, a total of $1200 when the money supply is still only $1000? How can each of the 10 people gain a monetary profit of $10 on their borrowed 100? Doing so would mean that each person would have $110 or a total of $1100 with a total money supply only $1000! This could only be made possible with an increase in the money supply. But, the money supply is only increased by more borrowing at interest! It’s mathematically impossible for all to save and profit. A few can, but only at the expensive of many. Would like to live in a world where you could only have a family if some one else lost their family? This how our money world works!

It’s hard to imagine how a few in the Banking system have deceived so many of our Nation’s people.

Thanks to illusion deceptively sold to the people over decades and the cost of interest and taxes, Americans now live under a constantly rising cost-of-living and a constantly growing fear that they may lose their job to some one who can be hired for lower wages.

A Credit money system ensures that the cost-of-living will rise to unmanageable levels for greater numbers of people. The switch to a Credit money system created the need for a safety net like Social Security and other costly, unworkable tax funded social programs. Our Credit money system insures that most, if not all businesses will sooner or later fail or be forced to restructure.

Our Credit money system forces us to use products of lower and lower quality or forces us to pay to very high prices for good quality products.

In a monetary system where money is created and put into circulation as interest-bearing loans only the principal is created-never the interest. The principal is debt and can be used as a medium-of-exchange. Interest is debt but it is never created. It cannot be used as a medium-of-exchange. When the principal is repaid it is extinguished. That amount of money no longer exists until more money is created by another loan. Currently, all money is debt but not all debt is money.

Once a person spends what they have borrowed, they must capture someone else’s loan principal in the process of commerce to repay the loan plus the interest on the loan. This causes an EXPONENTIAL GROW OF DEBT THAT WILL NOT STOP UNTIL WE AGAIN START PUTTING ALL NEW MONEY INTO CIRCULATION DEBT FREE.

Americans have a collective total debt of more than $59 Trillion. The MI money supply is around $7.7 Trillion. By 2016 the debt will have grown to the point (at just 6% interest) the annual interest due will be approximately one billion dollars greater than the total consumer income! The interest on this unpayable debt continues to grow and gets added to the costs of business and costs of living.

It is our hope that you will join and get active in the growing movement to Reform Our Money System and have all new money put into circulation debt-free.

Thank you!