THE BEGINNING

From the beginning, mankind has strived to make our life more comfortable. Starting as gatherers, mankind, through necessity, learned to use and get benefit from primitive tools. Mankind learned how to utilize agriculture and mining. People, through trial and error, using their labor and ideas, coupled with the natural resources of the earth have steadily improved their quality of life. As all the natural resources are not always available in one region, one area may produce agricultural products while another may have an abundance of wood or iron ore. People have always relied on each others skills to meet their collective wants and needs. This need for economic interaction enhanced the desire to trade and greater commerce slowly evolved.

Due to differing values of items to be traded, mediums-of-exchange began be adopted to enhance trade. The mediums-of-exchange have been many things including shells and beads. As an example a person agreeing to trade a cow for 100 chickens may not have wanted all the chickens at that time.

Therefore might agree to accept 10 chickens and 90 shells for his cow. He could then at a latter time trade some of his shells for more chickens or for some thing else. Silver, gold, iron, copper and other metals made into rough coins were also widely accepted as a medium of exchange.

History tells us that the word dollar (first called a thaler) originated as a piece of silver stamped into a rough coin by a German Count Stephen Von Schlick who was a miner and a merchant. If a person came to trade some thing of a greater value for some thing of a lesser value, the Count would give them some coins to equalize the value of the trade.

Value is only a state of mind based on emotions, a mental concept of how much I want to keep something, balanced against what I am willing to give up for some thing else. When two people agree on that point, value is set. Trade can take place. All exchanges (commerce) take place in one of two ways, fair and honest trade, where willing and knowledgeable people agree and trade, or theft by force or deception.

History tells us that banking came on the scene as a fair and honest deal between agreeing parties. However, it soon turned into theft by deception. The United States Treasury told me in a personal letter that our concept of banking originated with the goldsmiths during the seventeenth century. The goldsmiths had large vaults in which they kept the precious metals they worked with. People began to take their gold and silver to the goldsmiths for safekeeping. The goldsmith for a small fee would store other people’s gold and silver and give the people receipts (certificates of deposit) for the coins deposited in their vaults.

Imagine yourself as a rich person living in the seventeenth century. You have in your possession a large amount of silver and gold in coin form. You decide to take a trip however you don’t want to take all your coins with you. You decide to take your coins to the goldsmith and have him store it for you. The goldsmith gives you a receipt for the coins stored with him. Now you could go on your trip knowing your coins would be safe in a strong vault and you would have receipts to prove how many coins you had stored (banked) at the goldsmith’s.

While on your trip you decide to buy something that cost a few more coins than you have with you. You ask the seller if he would take one of the receipts for the coins you have stored with the goldsmith as partial payment. He agrees to do so. You decide that this is much more convenient than going back to the goldsmiths, producing your receipt, obtaining your coins and traveling back to make your purchase. You tell your friends how well it works to simply trade with the receipts instead of the coins.Appreciating convenience, it soon became a common practice to use the receipts as part of the medium of exchange, while leaving the silver and gold safely in the vault. Soon this concept of paper money was accepted throughout Europe.

(Note here that this paper money represented wealth already produced not interest-bearing debt owed to the goldsmith) The goldsmiths soon found themselves in possession of large amounts of other people’s coins.

The goldsmiths, like most men, were open to concepts that might enhance profits. Maybe it started when a close friend of the goldsmith came by and said “I decided to buy something but I am short a few coins. How about a loan? The goldsmith thought about the silver and gold stored in his vault that people seldom asked for because they were using his receipts as their medium of exchange. Thoughts of enhanced profits popped into his mind. “Yes, I will make you a loan. But, I will have to charge you a fee which we shall call interest for the use of the coins.”

However this fee will be a fee of a different nature. It will not be a one time fee like other fees are. It will be a fee that renews itself every month as long as you use the coins. In a few months the fee will be 2 to 3 times greater the value of the coins you borrowed. Borrowers should think of it they would a real estate agent who finds a house for a buyer for a small fee that over time becomes 2½ times the value of your house. Of course, you are never taught to think of it this way.

With that loan the goldsmith changed the money both in quantity and quality. The change in quantity is very clear and understandable. The money supply increased as soon as the goldsmith made the loan of the silver or gold coins because both the coins and the receipt for the coins were in circulation at the same time, both passing as money. The change in quality is not as clearly seen nor understood, but it’s just as real. When the goldsmith loaned the coins into circulation the money supply increased as interestbearing indebtedness, not as an increase in wealth as it was when the silver and gold was first coined. At that moment debt money (money that some one must borrow and be in servitude to another before it can exist) was born.

The more wily and dishonest goldsmiths soon realized that they could increase their economic advantage, power and monetary gains, if they kept the coins in the vault and just loaned out thee receipts [their promise to pay]. Unlike the coins multiple receipts for each coin held in the vault could be loaned out. That would have the same profit effect as increasing the interest rate on the original coin. If the interest rate on one coin was 10% when the goldsmiths loaned out 10 receipts for one coin, his interest rate on the coin would jump to 100% and no one would see or understand the increase in the lenders profits. To this day, few people have really under stood what happened or what is happening.

The news spread rapidly. If you were a little short on coins to complete a deal you could go to the goldsmith and sign a promissory note pledging some of your property as collateral. The goldsmith would loan you receipts [his promise to pay you] for the coins you needed.

The goldsmiths soon realized that if he demanded that most the interest on his receipts be paid in silver and gold. It would not take too many years until he would own vast amounts of silver and gold. Using the rule of 72 we find that if the goldsmith loaned out one gold or silver coin at 10% interest it would take him 7.2 years to double his money. However if he loaned out ten receipts for the one coin that he had it would only take him 8.6 months to double his money.

Over the years the goldsmiths’ turned into bankers and great financiers and gained great control over the people by increasing the money supply as loans. The facts show clearly that the banking system has become the slave master over all commerce and today they hold mortgages on most all the property in the world, either through direct loans or indirectly through loans to governments.

Even after the bankers gained the control and ownership of lots of silver and most of the gold through the interest earning from the issuing of excess receipts, it was very important for the bankers to keep everyone believing the real money was gold and silver and all their receipts were backed by gold and silver. That way few would ever question their right to issue the receipts that had become the most accepted medium-of-exchange.

To ensure that most economic writings supported their practices, the bankers found it is very much in their self interest to fund schools of economic thought and professors who teach in them. It is very important for the banking system to have people believe that banking and high finance is too complicated to be understood by the average person and is best left to the “experts” It is very easy to control the minds of people by controlling what is taught in the schools they attend.

College banking and economists courses teach that the goldsmiths simply increased the money supply, leaving out the fact that the ‘increased money supply’ was as interestbearing debts to the people and a 100% gain to the bankers, rather than more wealth to the people as it was when gold and silver were mined out of the earth. Obviously the amount of gold or silver had not increased, but the promise (obligation/debt) to pay gold or silver, did increase. When the goldsmiths created extra receipts, he also created a shortage of gold or silver. Soon the receipts for gold or silver in storage were greater than the amount of gold and silver stored. In more modern times, it was an easy step from making the loans in the form of a note promising to pay gold or silver, to just making the loans as book entries to the customer’s checking account.

Knowing that there was not enough gold and silver to cover their promises to pay, bankers had to get gold and silver demonitized (Roosevelt demonetized gold in the U.S, in 1933 and Nixon demonetized gold internationally in 1971) and declare it outdated and no longer useful as money. The minute gold and silver was demonetized, the original wealth dollar died and all that was left was the debt dollar. The original dollar was produced as wealth though the combination of labor and raw resources. (Man getting monetary benefit of his productivity). The new debt dollar was created by an act of deception designed to acquire wealth, produced by someone else, by fraud.

A couple of points that almost everyone misses, or at least refuse to talk about is, once all the medium-of-exchange is created as interest-bearing loans, there is no way to create the funds needed to pay the interest on the interest-bearing loans without creating more interest-bearing debt. The only way a borrower can pay his interest to the banking system is to capture, through commerce, some of the debt principal of another person’s loan. The bank system then claiming its own promises-to-pay as income from interest (no person can truthfully gain a profit by promising to pay him self) simply spend there own promises-to-pay to obtain anything they desire, including more of the newly mined gold and silver, without producing anything. This isn’t be fair trade’ its only theft by deception.

Interest on the banking systems promises-to-pay is great for the banking system but it is a great evil upon the borrowers. In the long run nothing can beat interest for generating a profit. It is the only thing that runs 24 hours a day, 7 days a week, 365.25 days a year. It never needs to sleep. It never needs to be stopped for repairs or servicing.

As time moved on, the men of banking began to really understand and believe in the power of money. Each generation worked to improve and enhance the system for their benefit. The Rothschilds, perhaps the greatest banking family the world has ever known, realized that it was really good business to loan to Kings and Governments, if the King or the Government had a good taxing system that would ensure them the interest payments. Meyer Amschel Rothschild said “Let me issue and control a nation’s money and I care not who writes the laws.” He had learned this lesson well from his predecessor William Paterson, who in 1694 created the First Bank of England. In return for giving the King a large loan Paterson’s bank was given a monopoly on the issuance of the nation’s currency. This currency was the promise-to-pay gold and silver coin that the bank nor Paterson had.

This brings us to the beginning of the United States. According to the United States Constitution Sesquicentennial Commission Representative Sol Bloom Director General, the meeting of the First Continental Congress was on September 5, 1774, in Carpenters’ Hall at Philadelphia. The Second Continental Congress met at Philadelphia on May 10, 1775 and endured until superseded in 1789 by the government organized under the new Constitution.

The Declaration of Independence was unanimously adopted in General Congress assembled at Philadelphia July 4, 1776 and states: “We hold these truths to be selfevident, that all men are created equal, that they are endowed by their Creator withcertain inalienable rights that among these are life liberty and the pursuit of happiness.”

On January 21, 1786, the legislature of Virginia, ignoring entirely the requirements of the Articles of Confederation suggested a general convention of Commissioners from the states to view the trade of the Union, and consider how a uniform system in their commercial relations may be necessary to their common interests.

The convention thus projected, met at Annapolis in September of 1786. The convention was attended by New York, New Jersey, Pennsylvania, Delaware and Virginia. Because of the limited attendance, nothing was done except to make a report, drafted by Alexander Hamilton. On February 21, 1787 Congress with eleven states being represented, took this report into consideration and resolved that a convention appeared to be the most probable means of establishing in these states, a firm national government. The Legislatures of all the states except Rhode Island appointed deputies to this Convention.

On May 29, 1787 Randolph from Virginia opened the main business by introducing the Virginia Plan drafted by Madison and worked on by the rest of the Virginia delegation. The deputies who feared a too strong central government introduced the “Paterson Plan on June 15. On July 16, 1787 came the adoption of the Great Compromise urged by the Connecticut deputies. Eleven of the States Ratified the Constitution by 1788. Washington was inaugurated President April 30, 1789. `

The Constitution of the United States reads: We the people of the United States in order to form a more Perfect Union, establish Justice, insure Domestic Tranquility, provide for the common Defense, promote the General Welfare, and secure the blessing of Liberty to ourselves and our posterity, do ordain and establishes this Constitution.

The Constitution in Article I Sec. 8 states: “The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense and general Welfare of the United States; – – – – To borrow Money on the credit of the United States; – – – – To coin Money, regulate the Value thereof, – – – – To establish Post Offices and post Roads; Then in Sec. 10 states: No State shall – – – – coin Money; emit Bills of Credit; make any Thing but gold and silver Coins Tender in Payment of Debts; – – – -.”

The ink that formed the above words of the Constitution was hardly dry when Alexander Hamilton and his backers, men who clearly understood the benefits and the profits that could come through banking practices, Hamilton had founded the Bank of New York in 1784, moved to place the newly formed nation into financial bondage to the banking system. Hamilton’s plan had four parts.

Part 1, establish a federal tax system.

Part 2, guarantee holders of Revolutionary War debt that they would be paid interest on that debt until the debt was repaid.

Part 3, the federal government would assume the war debts of the states. Part four, pass the Bank Act, which created a mostly privately owned bank and authorized the use of the debt certificates to purchase bank stock that would then serve as assets against which the bank could make loans, at interest, of money that the bank did not have; right from the play book of William Paterson.

Hamilton stated: (quotes have been reworded a little to flow better in today’s English) “It is a well-know fact, that countries in which the national debt is properly funded, (properly funded, means that the government has the taxing power to ensure the interest payments) it answers most of the purposes of money. Transfers of public debt are equivalent to payments in specie, or in other words passes as money. The same thing would, in all probability, happen here, under like circumstances. The benefits of this are various and obvious. Trade is extended by it; because there is a larger debt based interest-bearing money supply to carry it. Agriculture and manufacturing are also promoted by it; for like reasons.” From 1791 to 1796 prices rose 72% in response to the flood of new paper money issued as interest-bearing debt by the bank. Part one on his plan was implemented.

In July 1789 Congress passed a tax law mostly written by Hamilton. Part two was needed to get his fourth part passed. James Callender, a reporter for the Philadelphia Gazette charged; “The funding law was passed through Congress by the influence of a majority, who purchased certificates from the army at under value and who voted for the law, with the single view of enriching them selves. It is firmly believed and loudly asserted, by at least one half of the citizens of America, that the funding system was devised, not for the sake of paying real creditors but of wronging them. Hamilton planned, Congress voted. The president approved” Taylor, 1950, pp.61-4.

Part 3 of Hamilton plan was needed to ensure that the wealthy supported the federal government over the state governments because that would be the source of their interest

payment.

It seems The First Secretary of the Treasury, The First Congress, and First President supported a money supply based on debt because the majority of them had purchased

depreciated debt certificates before the Funding and Banking acts were passed into law.

This would have provided them with the ability to secure windfall profits for themselves.

The first congressman from Georgia, James Jackson, seemed to have been one of few people that understood where Hamilton’s plan would take the young nation. On February 9, 1790 he stated: “The funding of the debt will occasion enormous taxes for the payment of the interest. These taxes will bear heavily both on agriculture and commerce. It will be charging the active and industrious citizen, who pays his share of the taxes, to pay the indolent and idle creditor who receives them. It is doubtful with me whether a permanent funded debt is beneficial or not to any country.”

Some of the first writers in the world, who are most admired on account of the clearness of their perceptions, have thought otherwise and declared that wherever such funding systems have been adopted in a Government, they tend more to injure posterity. This principle is demonstrated by experience. The first system of the kind that we have any account of originated in the State of Florence in the year 1634. That Government then owed about £60,000 sterling, and being unable to pay it, formed the principal into a funded debt, transferable with interest at five per cent. What is the situation of Florence in consequence of this event? Her ancient importance is annihilated. Look at Genoa and Venice; they adopted a similar policy, and are the only two of the Italian Republics, who can pretend to an independent existence, but their splendor is obscured. They have never since the period at which said funding system was introduced, been able to raise themselves to the formidable state they were before. Spain seems to have learned the practice from the Italian Republics, and she, by the anticipation of her immense revenue, has sunk her status beneath that level which her natural situation might have maintained. France is considerably enfeebled, and languishes under a heavy load of debt. England is a melancholy instance of the ruin attending such engagements.

The same effect must be produced here that has taken place in other nations. It must either bring on a national bankruptcy, or annihilate our existence as an independent empire. Hence I contend that such a funding system in this country will be highly dangerous to the welfare of the Republic. It may, for a moment, raise our credit, and increase our circulation by multiplying a new form of currency, but it must hereafter settle upon our posterity a burden which they can neither bear nor relieve themselves from. It will establish a precedent in America that may, and in all probability will, be pursued by the Sovereign authority, until it brings upon us that ruin which it has never failed to bring, or is inevitably bringing, upon all the nations of the earth who have had the temerity to make the experiment. Let us take warning by the errors of Europe and guard against the introduction of a system followed by calamities so universal. Though our present debt be but a few millions, in the course of a single century it may be multiplied to an extent we dare not think of.” (Annals of Congress, Vol. I, February 1790).

Today we are seeing the fulfillment of Jackson’s words. Hamilton’s plan did establish a precedent that has been pursued and refined by the sovereign authority to a point where the Federal Reserve banking system and the corporations that have grown up around it has become an unelected all powerful fourth branch of government, that control all the other branches (Today, we have the best government corrupt money can buy). Today, all our money is created as interest-bearing loans. “All bank deposits are a form of credit. Basically, they represent amounts owed by banks to depositors. They come into existence by an exchange of bank promises to pay customers for the various assets which banks acquire – currency, promissory notes of business, consumer, and other customers, mortgages on real estate, and Government and other securities.” The Federal Reserve System purposes and Functions, Third Edition pg. 6 “the actual creation of money always involves the extension of credit from private commercial banks.” “The bank owns all the money all the time the customer only borrows it.” Russell Munk, assistant general council for the U. S. Treasury. “If all the bank loans were paid, no one would have a bank deposit and there would not be a dollar of coin or currency in circulation”. Robert H. Hemphill, credit manager of the Federal Reserve in Atlanta.

When all money is created as interest-bear loans, there is no way to create the

money needed to pay the required interest. “The money to pay the interest on loans,

comes from the same source as all other money.” Russell Munk

In other words, it has to be borrowed from a commercial bank. “The money that one borrower uses to pay interest on a loan has been created somewhere else in the economy by another loan”. John M. Yetter, U. S. Treasury “Money is created when loans are issued and debts incurred, money is extinguished when loans are repaid”. John B Henderson, Senior Specialist in Price Economics, Congressional Research Service, The Library of Congress

In December 1791 the Bank of the United States opened. A first loan for $400,000 was made in May 1792. By 1795 the total borrowing from the Bank of the United States was $4,500,000; by 1796 it was $6,200,000. Because of the fraudulent monetary system Hamilton introduced, each generation has been forced deeper into debt than the generation before it. Until now the total debt is over 60 trillion and growing at a rate of nearly $5 trillion yearly.

As Jackson envisioned, the same effect has happened here that has always taken place in other nations. By 2016 the debt will be so great that the interest on the debt at just 6% will be over a billion dollars greater that the total consumer income! We will be facing national bankruptcy, on the business level, the consumer level and all governmental levels.

According to the Grandfather Economic Report found at http://mwhodges.home.att.net/nat-debt/debt-nat.htm. The Grandfather Economic Report has been endorsed by both Gerald P. Dwyer VP of the Federal Reserve Bank of Atlanta and Dr. Milton Friedman.

Rob Grunnewald of the Federal Reserve Bank of Minneapolis has confirmed that the figures of this chart seem to be accurate. Since this chart was created the Total Debt has increased to near $60 Trillion.

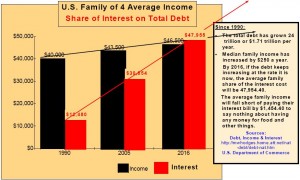

The total debt, in 1990, was $13 trillion, This includes the household (consumer) debt, the business debt and federal, state and local government debt. This doesn’t include the huge un-funded government liabilities. This amounts to $52,000 per person or $208,000 for a family of four. That family’s share of servicing the interest load on that debt, at 6% would have been $12,480 per year. In 1990 the median family’s income was $40,000.

Currently, America’s total debt is near $60 trillion dollars, much more than the 2004 figures of $128,560 per man woman and child and $514,240 per family of four. Now the family’s share of servicing the interest load on this debt, at 6 percent, would be more than $30,854.40 per year. According the U.S. Dept. of Commerce the median family income is $43,500.

The total debt has grown $24 trillion, or $1.71 trillion per year since 1990. The additional interest load has grown by $102,600 billion a year since 1990. This means that the interest load for a family of four has increased by an average of $1,425 a year since 1990. If the debt keeps increasing at the same rate, by 2016 the median family’s share of servicing the interest cost will be $47,954.40.

The median family income has increased by $250 a year since 1990. If their income increases at the same rate their annual income, by 2016 will be $46,500. This means the Median family’s income will fall short of paying their share of the interest bill by $1,454.40 to say nothing about having any money for food and other things. The expanding interest load will have surpassed the total consumer income.It has become very clear that we can’t borrow our way to prosperity.

It’s sad but the majority of the people don’t understand the (SINISTER NATURE OF INTEREST). Many understand they pay interest directly when making house, car and other installment plan payments. Very few however, realize that this is only a small part of the interest bill they pay. They don’t realize that most businesses have huge debts and the interest on those debts is passed on to the consumer though higher prices. They don’t realize that the federal, state, county, city governments and school districts have huge debts, and that the interest on those debts is passed on to the consumer though higher taxes and fees.

“If all the bank loans were paid no one would have a bank deposit and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash or credit, If the banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It (the banking problem) is the most important subject intelligent persons can investigate and reflect upon. It is so important that our present civilization may collapse unless it becomes widely understood and the defects remedied very soon.” Robert Hemphill Federal Reserve of Atlanta

The defects in our money system are that “The actual creation of money always involves

the extension of credit by private commercial banks”. Russell Munk U.S. Treasury

Therefore there is no way to create the money needed to pay the interest, which is charged, on the extensions of credit. People clearly do not understand that all interest increases the debt owed, but does not increase the money supply! This therefore makes the total debt unpayable. The best we can do is, pass the debt on to someone else then on to the next generation. That is why every generation must get deeper in debt to keep the system working. Do you care about your children’s future?

All the perplexities, confusion, and distress in America arise not from defects in their constitution or confederation. Not from want of honor or virtue so much as from downright ignorance of the nature of coin, credit, and circulation. John Adams

As this debt compounds, it is obvious that the consumer has less and less discretionary income and businesses have less profit and more individuals, businesses, state and local governments will be forced into filing bankruptcy.

For more than 250 years workers throughout this nation have created immense wealth by

combining their ideas and labor with natural raw resources of the earth. There is no debt

in this process so how did we get over $60 trillion in debt?

Look around. What do you see? Millions of homes, automobiles, skyscrapers, airlines, factories, railroads, and farms, (but not nearly as many as there use to be), all produced as wealth and with profits in mind! I asked Erick Gandrud, President of the MN Bankers Assn., if he could name 5 things that are not produced as wealth assets? He replied: “Everything is produced as an asset?”I asked him,”If everything is produced as an Asset, how did we get so much debt?” He replied, “It’s our crazy bookkeeping system.”

If working Americans created all of this wealth, and run all business with the intent of gaining profit, why are we collectively over $60 trillion in debt? This debt is increasing daily. This includes Federal government, non-financial Corporate, and personal household debt, yet our total MI money supply is less than $1.4 Trillion. Why does approximately 5% of the population own 80% of this wealth? The answer can only be found by looking at how our money is created and put into circulation. These facts were stated in the above writing but are so important that we will restate them.

To find answers to the above questions we wrote to the U.S. treasury and others and

asked questions.

1. How is money created and how does it get into circulation?

Russell L. Munk, answering for the Treasury stated: “the actual creation of money always involves the extension of credit from private commercial banks.” This means interest bearing loans.

2. If all money is created as debt and put into circulation through loans, where does the money to pay the interest on the loans come from?

John M. Yetter answering for the Treasury stated “the money that one borrower uses to

pay interest on a loan has been created somewhere else in the economy by another loan.”

In other words, all money is created by private commercial banks as loans. The borrower who spends the money must capture his debt principal back and enough of someone else’s debt principal, through commerce, to pay the interest on his loan.

3. What happens to money when a loan is repaid?

John B. Henderson, Senior Specialist in Price Economics, Congressional Research

Service, The Library of Congress answered that question by stating: “Money is created

when loans are issued and debts incurred; money is extinguished when loans are repaid.”

What would happen if all loans were paid off?

Robert H. Hemphill, Credit Manager of the Federal Reserve Bank of Atlanta, stated:

“If all the bank loans were paid no one would have a bank deposit and there would not

be a dollar of coin or currency in circulation.”

This means that under our present monetary system to have money, we must have interest bearing debts. Interest and time makes the debt grow but time and interest does not make the money supply grow. With each interest bearing loan, we are creating a debt greater than the debt money supply. The spread between the debt and the money supply must grow greater with each passing day. As interest is a cost of doing business, the greater the interest-load, the harder it is to generate a profit. The harder it is to generate a profit the harder it is to pay the interest. The harder it is to generate a profit the greater the pressure to cut both your labor and raw resource costs. The more you cut wages, the harder it is for the wage earners to buy the things they need and want without borrowing more. This leads to excess debt and a shortage of money for nearly everyone, until finally the interest load becomes greater than the total income of the nation. (See previous chart.)

This is why more members of families must work more jobs and longer hours to try to maintain the same standard of living.

This is why you see large companies moving their production lines to countries where laborers are paid less. This leads to trade deficits where more money flows out of the country to buy imports than flows back to buy exports. This causes the additional loss of many factories and the ability to produce the things we need in our own country. America has lost most of its production base to outsourcing and off-shoring. Those jobs have been replaced with lower paying jobs in the service sector. That is why we are told that we are and must move into a service economy; thereby slowly killing our own markets. It’s a spiral stairway going down a circular path to national destruction unless we change the way money is put into circulation.

John Maynard Keynes said: “There is no subtler, no surer means of overturning the existing basis of society than to DEBAUCH the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which only one man in a million is able to diagnose.” The only way to DEBAUCH money is to change it from a representation of wealth to an evidence of Debt!

In 1792 the new congress passed the 1792 Mint Act that stated in part: Sec. 9 And be it further enacted, That there shall be from time to time struck and coined at the said mint, coins of gold, silver and copper, of the following Eagles each the value of ten dollars and to contain two hundred and forty-seven and one half grains of pure gold. Half Eagles — each to be the value of five dollars and to contain one hundred and twenty-three grains and six eighths of a grain of pure gold. Quarter Eagles – each to be of the value of two dollars and a half dollar, and to contain sixty-one grains and seven eighths of a grain of pure gold. Dollars – each to be value of a Spanish milled dollar as the same is now current, and to contain three hundred and seventy-one grains and four sixteenth parts of a grain of pure silver. Half Dollars – each to be of half the value of the dollar and to contain one hundred and eighty-five grains and ten sixteenth parts of a grain of pure silver. Quarter Dollars – each to be of one fourth the value of the dollar and to contain ninety-two grains and thirteen sixteenth parts of a grain of pure silver. Dismes (dimes) – each to be the value of one tenth of a dollar and to contain thirty-seven grains and two sixteenth parts of pure silver. Half Dismes (nickels) – each to be the of one twentieth of a dollar, and to contain eighteen grains and sixteenth parts of a grain of silver. Cents – each to be of the value of the one hundredth part of a dollar, and to contain eleven pennyweights of copper.

Sec. 14 And be it further enacted, That it shall be lawful for any person or persons to bring to the said mint gold and silver bullion, in order to their being coined; and that the bullion so brought shall be there assayed and coined as speedily as may be after the receipt thereof, and that free of expense to the person or persons by whom the same shall have been brought. —

Looking at and comparing the basic concepts of these two pieces of legislation, Hamilton’s banking legislation and the 1792 Coinage Act, one can only come to one of two conclusions:

- Either these laws came from some very confused minds that did not understand anything about the working of banking and the role that money plays in the lives, fortunes and the destiny of the people of a nation.

- Or these two pieces of legislation were well planned by keen minds that really understood the finer points of banking and the benefits that go to the small portion of the population that controls the issuance of the nations money supply as interest-bearing loans and wanted to ensure that they would keep getting those benefits by fostering the idea that gold and silver was the only real money and the bank was simply loaning gold and silver that it owned.

Let’s closely scrutinize the basic concepts of these two pieces of legislation. Starting with the one passed first.Chartering a bank to issue money as interest bearing debt.

Hopefully we have covered this quite well in what has already been written, so I will only summarize here. The issuing of money as interest bearing debts is simply the monetization of the people’s production as assets to the banking system and unpayable debts to the people.

When money is created as interest-bearing loans by the banking system, the banking system ends up owning and controlling everything and the people end up being economic slaves to the banking system and their unpayable debt. Having at least 90% of all their production taken from them either through interest or taxes. As war is one of the best justification for greater indebtedness this also leads to almost constant wars.

If we closely examine the principles of coining gold and silver into money we see that it has nothing to do with gold or silver. It is simply the monetization of the people’s production as wealth to the people with no debts to anyone. Think about it. That is all gold and silver is, a raw resource of the earth extracted from the earth by the labor of people. If the government stamps that material into coins free of charge, what really has happened is that the government has monetized the production of the people as wealth to the people without debt. This gives the people the monetary benefit as well as the physical benefit of all that they produce without debt to anyone. That is what makes a truly free, prosperous and peaceful people.

There are ways to monetize the production of the people as wealth to the people that are

much more beneficial to them than using gold and silver.

If our founding fathers had really understood the above facts there was no reason for them declare gold and silver money. A new young country that didn’t have any known gold and silver mines in their country would be crazy to declare some thing that they did not have as their money. The fact that the country had already issued paper money, used tobacco and other things as money instead of building a mint proves that they did not have any gold and silver mines of their own. Where and how was this young nation going to get the gold and silver that is was going to use as it’s medium of exchange?

The young nation in its constitution, gave itself the power to make up money and the duty to provide the county with post offices and post roads. If the young nation would have really understood money (as a medium-of-exchange), they would have issued paper money as payment, in lieu of taxes, to build the post offices and the post roads the nation needed. Not issued money as interest bearing debt to a bank that didn’t produce anything. If they had today this nation would be the greatest, wealthiest nation on the face of the earth with no debts to anyone. If we had taught the rest of the world to do the same, we would have a wealthy peaceful world. Not a world full of poverty and misery.Since our monetary system was DEBAUCHED, our economy has been forced marched towards destruction by interesting-bearing debt.

The only way stop the headlong rush to destruction is to reform our money to where it is a representation of the wealth the people produce; not an evidence of interest-bearing Debt owed to the banking system! This could easily be done by creating the money and spending it into circulation to rebuild the nation’s transportation system.

It appears that we don’t have a lot of time to remedy the defects in our economic system. It’s time that intelligent people, who care about themselves and their children, address this problem.

Researched and Prepared by the Citizens for Better Transportation

7007 Lynmar Lane, Edina MN 55435, Ph. 952-925-6099