The real reason gold and silver coinage initially worked well as money for the people, is that the people produced the gold and silver, a raw resource of the earth, through their labor. The 1792 Coinage Act allowed anyone to take that resource to the United States mint and have it monetized (coined) free of charge. We, the people, furnished our own money, based on our production, as a wealth to ourselves and spent it into circulation as a benefit to all of society with no debt attached to it.Gold and silver are very heavy metals and not as convenient to carry as paper money. If we didn’t want to carry the gold and silver coins around with us we could take them to the United States Treasury and store/deposit the coins.

The real reason gold and silver coinage initially worked well as money for the people, is that the people produced the gold and silver, a raw resource of the earth, through their labor. The 1792 Coinage Act allowed anyone to take that resource to the United States mint and have it monetized (coined) free of charge. We, the people, furnished our own money, based on our production, as a wealth to ourselves and spent it into circulation as a benefit to all of society with no debt attached to it.Gold and silver are very heavy metals and not as convenient to carry as paper money. If we didn’t want to carry the gold and silver coins around with us we could take them to the United States Treasury and store/deposit the coins.

The Treasury would issue depositors gold and silver certificates as receipts. They stated on their face that there was X amount of gold or silver coin on deposit in the Treasury, payable to the bearer on demand. Now, we had paper money.

As long as just this principle was followed you still had good, honest, wealth money with no debt, no excessive profit, nor excessive purchasing power to anyone.

However, when someone deposited their gold and silver coin in a fractional reserve bank, a totally different principle went into action. The bank held the coins as a reserve and expanded the money supply by making new loans equal to 10 times the face value of the coins deposited. At that point, money switched from wealth to debt.

Americans have lacked this understanding. Lack of understanding is why America is the world’s greatest debtor nation with over $70 Trillion in public and private debt in 2018.

On January 24, 1939, Robert H. Hemphill, credit Manager of the Federal Reserve Bank of Atlanta stated:

“If all the bank loans were paid no one would have a bank deposit and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the banks create ample synthetic money we are prosperous: if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture the tragic absurdity of our hopeless position is almost incredible, but there it is. It (the banking problem) is the most important subject intelligent persons can investigate and reflect upon. It is so important that our present civilization may collapse unless it becomes widely understood and the defects remedied very soon.”

At first glance, fractional banking looks like a good deal for everyone. The banks get more profit. The people can get quicker and easier loans. More capital is available to engage in commerce. Production picks up. But, sooner or later, more and more people can not make their loan payments. An unseen by-product of fractional banking is: it makes some people rich, (about 250,000) and leaves many more people very poor (about 150 million). All the while, fractional banking creates compounding, unpayable public and private debt, which causes the cost of living to constantly go up for all Americans.

Throughout the nineteenth century, larger banks worked to get laws passed that would consolidate all fractional banking under the control of just a few. They did so under the guise of a standardized national money. They were successful in 1863 with the passage of the National Banking Act. It allowed newly chartered national banks to create a uniform national bank currency. A few years later the federal government taxed state bank notes out of existence. In 1873, the government stopped all free coinage of all silver. They began to use United States Certificates of indebtedness — United States Bonds — as security for the national currency.

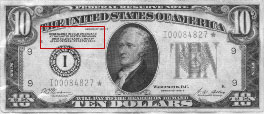

The note states on its face “The Federal Reserve Bank of Minneapolis Minnesota will pay to the bearer on demand one dollar — Federal Reserve Bank Note”

However, it no longer said a dollar of what, like the gold and silver certificates. It also says “secured by United States Certificates of indebtedness” You can now clearly understand why our government and private sector are so deeply in debt. All we use for money is (monetized) DEBTS.

The switch from wealth based money to debt-based money had been completed. Americans were now in Economic Servitude, forced into debt to get money created and into circulation. All that was left was to change the notes.

Changing the Notes

The banking system did this one small step at a time. It’s easy to see on the 1928 Federal Reserve note below that the banking system wanted us to believe that their note was the same as a gold certificate.

On it’s face it read: “Redeemable in gold on demand at the United States Treasury or in gold or lawful money at any Federal Reserve Bank”. Notice that they didn’t claim that the note was a dollar. But said — WILL PAY TO THE BEARER ON DEMAND — DOLLARS.

It was not a certificate of wealth — it was a bank note — an evidence of debt — put into circulation as an interest-bearing LOAN. Now we had a completely different set of principles at work. This point has been missed by most everyone. Of course the banks issued many times more gold notes than there was gold.

Later, on the 1934 series Federal Reserve note, we no longer find “redeemable in gold” (in 1933 free coinage of gold was stopped and all the gold was taken from the people and demonetized. The bank-controlled government made it a crime to own gold. It was 40 years before the people could own gold and when they could it was no longer money.

Later, on the 1934 series Federal Reserve note, we no longer find “redeemable in gold” (in 1933 free coinage of gold was stopped and all the gold was taken from the people and demonetized. The bank-controlled government made it a crime to own gold. It was 40 years before the people could own gold and when they could it was no longer money.

Now the note reads “This note is legal tender for all debts public and private and is redeemable in lawful money at the United States Treasury or at any Federal Reserve Bank” WILL PAY TO THE BEARER ON DEMAND — DOLLARS.

Notice again, they didn’t claim that the note was the dollars, but said — WILL PAY TO THE BEARER ON DEMAND — DOLLARS. The note admits on its face that it isn’t lawful money, because it states it is redeemable in lawful money. It said nothing about what lawful money was. With the words promise to pay written on its face, it met the specifications for a legal note (negotiable paper).

The 1950 Series Federal Reserve note, shown below looks and states the same thing as the 1934 note except the size of the wording about legal tender and redeemable in lawful money has been reduced to just 3 lines and to an almost unreadable size, clearly no one was reading the words on the notes anymore.

Let’s examine very closely the Federal Reserve notes in use today. There are major changes. The note only says, “This note is legal tender for all debts public and private” Gone are the words “Redeemable in Lawful money”. Gone are the words “WILL PAY TO THE BEARER ON DEMAND” The Federal Reserve note is no longer a legal promissory note (negotiable instrument). The note has now become the Dollar. The only thing we have for a medium of exchange — Money — is a credit at the bank. This credit is loaned into circulation at interest. When the interest is due the total debt is always greater than the money supply. The debt obligations are greater than the supply of “money” to fulfill the obligations incurred by the people, resulting in unpayable compounding debt which constantly raises the costs of living, and shifts influence and the ownership of property from the many to a few.

In the banking system’s greed and drive to protect their theft by deception — (fractional banking) and to protect themselves from bank runs, etc., the banking system put themselves into a catch 22. As long as there was free coinage of metals or some other form of wealth (debt free) money, the interest on the bank loans, or at least part of the interest could be paid with the wealth (debt-free) money, therefore the debt would grow more slowly. It would not mathematically, be forced to grow. Now that all the wealth money has been removed from the system, there is no way to pay any of the interest, so the debt must constantly compound.

Michael Hodge’s Grandfather Economics Report states that America’s Total debt in 2010 was $57 Trillion and growing. Most of this debt is accruiung interest. Yet, America’s Total money supply of ‘liquidity’ was just over $7.7 Trillion and it’s a debt too! “Money is created when loans are issued and debts incurred, money is extinguished when loans are repaid.” (Congressional Research Service) Interest earned on investments is not new money. Interest earned on investments is only other loan-principal captured as profit in the process of commerce. We can’t add to the current money supply of $4+ trillion without also increasing the debt. If we reduce the indebtedness by $4 trillion we extinguish the total money supply. In a debt-credit money system money must constantly accrue interest due if it is to exist. When money is created as a loan, it is money and it is a debt. But, the additional interest that must be repaid is not money. it is ONLY A DEBT expected to be paid in money. If not paid, it must constantly accrue more interest debt due.

In a debt-credit money system, interest cannot be paid without putting someone else deeper into debt. The resulting shortfall must be added to the price of finished goods and services. The total debt is transferred and continues to compound when a seller manages to capture his total principal plus interest debt in the market place and repay a bank loan. As the spread between prices and the money supply increases your money buys less, it loses buying power. Eventually, as prices increase far enough beyond the total money supply, you will not be able to work enough hours to buy anything. (See Chart example) You won’t be able to borrow the money to purchase the item either because the amount of hours you can work (24 hours daily) will never produce enough ‘value’ to collateralize a loan big enough to meet the item’s selling price. Yes, there are some very successful people but they are becoming fewer. Eventually they will be weeded out because they too are consumers. As prices for everyone continue to rise beyond the money supply more and more of the wealthy (top competitors) will fall on hard times. This is what’s now happening worldwide. We are now constantly aware of two major questions. They are: Why is everything getting so expensive? Where will we get the money to pay the prices?

You can see the progression historically. It used to take just one worker to support a family and the families were larger. Today, one worker’s hours aren’t enough. Two paycheck households are the norm. Even now, two-paycheck households are having more difficulty making ends meet. Our debt-credit system makes ownership of property more and more difficult. For more and more people, a declining standard of living is the future. The solution is to slowly stop the creation of money as an unpayable, interest-bearing debt loaned into circulation. At the same time we must bring new money into circulation debt-free as a Wealth-a payment for work done (production) that benefits all (roads & bridges) in lieu of taxation, borrowing or debt.