Do you want to understand what a balanced budget it?

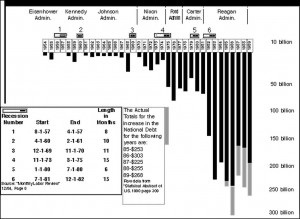

This graph shows the history of the United States surpluses and deficits from 1954 to 1989. The recessions are numbered and plotted on the graph.

Has The Balanced Budget Been Understood?

We are told we must have a balanced budget. Look at the record and find out what happens when we do. Shortly after each balanced budget we had a recession. Check the record. Notice the many years between numbers two and four. No surpluses and no recessions until the surplus in 1969. By December, 1969 number three started. No one has dared to balance the budget since.

The large deficit in 71 and 72 got the economy going again. The deficit was reduced in 73 but before the budget could be balanced , number four started November 1, 1973. The pattern was repeated with numbers five and six.

We had number four when the deficit was reduced to about $5 billion, number five at about $40 billion, and number six at about $70 billion. Recessions five and six were so close, because the deficit in 81 was too small to keep the recovery going. Just look at the huge deficits required to end number six.

Since 1985, many items have been taken ‘Off Budget’ to hide the true size of the deficit.

Note the large reduction from 86 to 87. Could this be the reason for the October 1987 market crash? Economist predicted a depression within six months. Why were they wrong? The 88 and 89 debt increase figures tell us the answer.

The government borrowed enough to stimulate the economy out of the predicted depression.

Since 1792, our monetary system has been switched from a wealth based monetary system to a monetized debt-based monetary system. Under constitutional principles, our money was to be a representation of wealth and spent or traded into circulation.

Now our monetary system is based on debt. Every form of money now in circulation was put into circulation as a loan or as a debt to someone. When interest is charged on the loans it mean that the debt is always greater than the money supply. In order for the economy to function there must be an ever expanding debt. Is this fiscal responsibility?

If the debt is not continually growing there is a money shortage. That is the reason that each time there is a reduction in the deficit a recession follows.. A money shortage is what causes recessions. The media doesn’t tell you this. Why not? Is this the kind of system that fosters fiscal responsibility?

Maybe it’s time ‘we the people’ begin to think for ourselves. The only way out of this mess is to go back to the principle of wealth money, money that is created and paid or traded into circulation, not loaned into circulation. It’s time that people who understand get to work telling friends and neighbors that the root of America’s economic problems is our flawed money system.