Except for concepts of the mind, all things consist of known chemical substances. All new wealth is created by combining ideas, labor and raw resources. Year after year, farmers and ranchers produce billions of pounds of new, renewable wealth— grain, beef, pork, milk. Unless one has eyes that do not see or ears that do not hear, it’s clear that people in agriculture are hurting.

Except for concepts of the mind, all things consist of known chemical substances. All new wealth is created by combining ideas, labor and raw resources. Year after year, farmers and ranchers produce billions of pounds of new, renewable wealth— grain, beef, pork, milk. Unless one has eyes that do not see or ears that do not hear, it’s clear that people in agriculture are hurting.A wise man once said, “ It’s easy to know when tyrants are in control of a country. The crops are good, the cattle are fat, but the people are poor.” Every year, more producers are forced off the land because they can’t service their debts and maintain a decent standard of living at the same time. Many survivors are unable to update their buildings and equipment. The results of the average farmer and rancher always producing many times more than he and his family consumes should be monumental savings not insurmountable debt.

Producers are often told that, “they need a banker who understands agriculture.” I contend that it is of first importance that producers understand banking! This knowledge makes it easier to understand what’s happening in agriculture.

How can it be that the banking system which produces nothing from raw resources always has all the money while the people who produce all the new wealth by combining labor, ideas and raw resources, collectively go deeper into debt to the banking system each year? The banking system creates no new wealth. Working with no substance, only mental deception, the banking system expends labor only when accounting for wealth produced by someone else or when selling people on the idea that life and business cannot proceed without using the banking system’s concept of the mind called ‘bank credit’.

Why do the working people produce all the new wealth while the banking system owns all the money? Let me share with you answers I received from the United States Treasury to these questions: What is money? Where does money come from? How is it created?

Russell L. Munk, Assistant General Counsel, answered, “The Board of Governors of the Federal Reserve System has the responsibility for determining United States monetary policy…….when the economy grows there are more economic transactions and more money is needed to pay for them….if the money supply is to be increased, money must be created….the actual creation of money always involves the extension of credit by private commercial banks…in modern banking, new money is created by offering loans to customers.  A private commercial bank which has just received extra reserves from the Fed…..can make roughly six dollars in loans for every one dollar in reserve it obtains from the Fed. How does it get six dollars from one dollar? It simply makes book entries for its customers saying, “you have a deposit of six dollars with us.” You may want to know whether the bank is the one getting the benefit of the new money since the bank owns the new money while the customer has merely borrowed the money. The bank does indeed get the benefit of the new money.” I then asked , “If money is only created by the extension of credit and a book

A private commercial bank which has just received extra reserves from the Fed…..can make roughly six dollars in loans for every one dollar in reserve it obtains from the Fed. How does it get six dollars from one dollar? It simply makes book entries for its customers saying, “you have a deposit of six dollars with us.” You may want to know whether the bank is the one getting the benefit of the new money since the bank owns the new money while the customer has merely borrowed the money. The bank does indeed get the benefit of the new money.” I then asked , “If money is only created by the extension of credit and a book

entry, where does the money come from to pay interest on the borrowed money?” Mr. Munk replied, “Money for paying interest on borrowed money comes from the same source as other money comes from.” (someone must borrow that money also.) John M. Yetter, Attorney advisor, Department of the Treasury explained it better by stating, “Money that one uses to pay interest on a loan has been created somewhere else in the economy by another loan.” Collectively, producers get deeper into debt while the banking system gains ownership of more and more assets.

Rising debts and increasing bankruptcies (1.5 million in 1997 up 20% over the 1996 record high) are the results of Congress suspending the free-coinage of metals into money and switching us to bank credits as our medium of exchange.

These acts converted America from: a wealth monetary system (the government ‘monetized’ a portion of the peoples’ production free by minting coins from the gold and silver people mined from the earth; the wealth they produced.)

This created a debt-free medium of exchange for society that enhanced the exchange of all the other goods the people produced to: a debt monetary system where now all new money is loaned into circulation when we sign security agreements pledging (collateralizing) our production as assets to the banking system. We borrow the numbers the bank creates by simply writing them in its ledger. This system flys-in-the-face of the spirit and intent of America’s founding principles of Freedom, Justice and Liberty! Why? Because it forces us to incur unpayable debts to have a medium of exchange. When all new money is loaned into circulation at interest, only the principal amount of each loan can be put into circulation.

When the interest comes due on the first loan, the debt owed (obligation to pay) is greater than the money supply. It’s impossible to pay the total debt in the same money that was borrowed. Every loan of newly created money would end in default if it had to stand alone. Every mortgage would be foreclosed. Yes, if some borrowers care less about the welfare of others, they can shift the debt to their children and neighbors. Remember. Mr. Yetter said, “Money that one borrower uses to pay the interest on a loan has been created somewhere else in the economy by another loan.” So, the profit and savings that some people have has been created as loans to someone else. Most of these loans start with government debt.

Most farmers and ranchers go to financial organizations at least annually to renew their notes. Most people obtain loans to buy houses, cars and practically everything else. Credit card usage is high. Why aren’t these things paid for from savings? Because there is no money unless we borrow and go into debt! When the Principal debt is repaid, the money is uncreated forcing us to borrow again to have money.

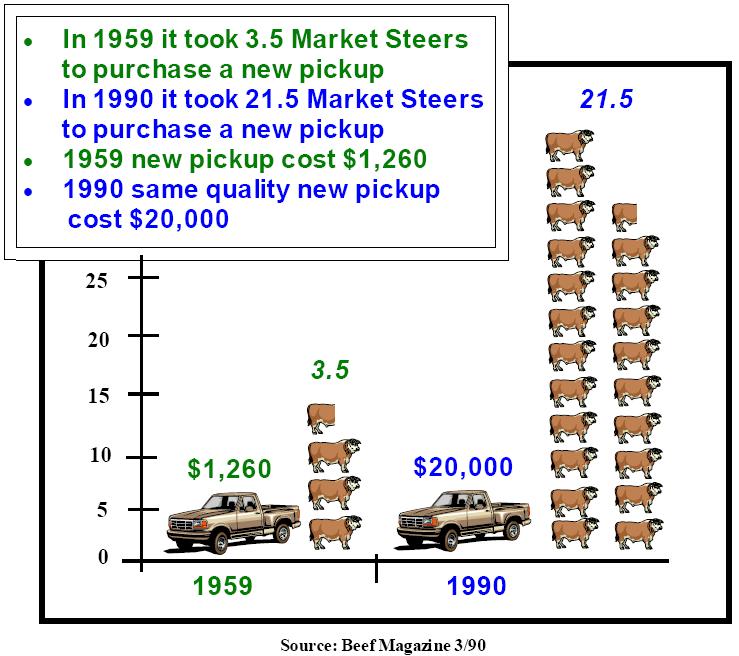

The unpayable cost of money (interest) is always added as a markup to the costs of living. This results in constantly rising prices (except for commodities) and a growing difficulty making ends meet. Producers at the bottom of the ‘food chain’ who cannot ‘markup’ must constantly try to meet the costs of borrowing passed onto them by suppliers. The results of creating all money as interest-bearing loans are: a constantly growing spread between the price of inputs and the prices received for production, a diminishing number of farms and more and more property owned by fewer and fewer people.

How can it be possible for the Federal government to be nearly $6 trillion in debt and run a yearly deficit? It’s the only entity authorized by law to coin money and can do so at a profit while taxing from the people up to half of all the money they earn and spending it! After paying so much in taxes, who could have enough money to loan the Fed government nearly $6 trillion and still have money to lend local governments and the private sector over $21 trillion? How? Especially when the total amount of legal tender money is less than $400 billion? Simple! Our money is not coined nor printed by the government. It’s simply created as unpayable debt by banks as numbers on their ledgers—checking account money called ‘demand deposits.’

To restore true prosperity we must return to a debt-free money system. This will enable us to increase the money supply without increasing our debt, pay the debt out of the system without shrinking the money supply, restore the purchasing power of our money, Economic Justice, Honesty and Freedom!

Save your property. Stop a ‘few’ from unfairly owning everything. Restore the just, moral and enjoyable principles of living to which agriculture once proudly laid claim. Make it easier for young people to get into farming. Make it easier to ‘pass on’ the family farm.

Help return economic freedom to America through a debt-free medium of exchange Spent not Lent into circulation!

Spend ‘Em! Don’t Lend ‘EM!