Money Without Banks

debtfreemoney.org

Most writings about monetary reform today only write about banking system reform! To get the monetary reform necessary we must understand that a money system can exist without a banking system. However, a banking system cannot exist without a money system. The first concern regarding a money system should be the PRINCIPLE used to put all the new money into circulation.

Money without a banking system!!!

Incurred No Debt!

The Bible states that in the beginning, from nothing, God applied effort to a formless void and darkness and created the earth and the fullness thereof. God saw that it was good then created man, blessed them and commanded them to be fruitful, fill the earth and subdue it. God informed them that he had provided all they could possibly ever need. God did all this and incurred no debt.

Labor and Raw resources.

Kick over an anthill. Come back later. You’ll see that it has been rebuilt as if nothing ever happened. The ants applied their labor to the raw resources around them and rebuilt there home. The ants benefit equally and freely from their production while incurring no debt, taxes or fees in the process.

All the resources we need exist! They come from the earth. When we apply our physical and mental energies to these natural resources we can change their form to better serve our needs and wants. We can create new products; recycle old products to make new ones. Most, if not all resources are renewable through the natural reproduction process. There is constant movement of resources and resources changing form. The main function of money is to improve the movement of resources to better serve us. Money should simply represent the people’s production and be spent into circulation as a final debt-free payment.

Money, in and of itself, is not a natural resource. Money is simply a man-made mental concept. Money can’t clothe, feed or shelter us.  Money is just a mental tool used to make the exchange of goods and services more efficient. History tells us that many things have been used as money. Today, we use NUMBERS as money. Therefore, we know that what we use as money is not very important. It is the PRINCIPLE used to move new money into commerce that determines if we have economic Freedom and Liberty or Economic Bondage; whether the entity that produces the money is the Master or the servant of the people.

Money is just a mental tool used to make the exchange of goods and services more efficient. History tells us that many things have been used as money. Today, we use NUMBERS as money. Therefore, we know that what we use as money is not very important. It is the PRINCIPLE used to move new money into commerce that determines if we have economic Freedom and Liberty or Economic Bondage; whether the entity that produces the money is the Master or the servant of the people.

Long before we had banking systems, we had the ability to work, produce wealth and trade it among ourselves. Commerce requires no debt. However, special interests have used misinformation to reverse the roles of the monetary and banking systems. This misinformation has been used to confuse the authorities and responsibilities of the banking system and Congress so that our money is now created as a total profit for the banks and as interest-bearing debts to the people, when the banks make loans. Today, contrary to money’s past history, if someone is to engage in commerce using money, someone must be in debt and economic servitude. All new money is loaned at interest into circulation. This fact is what has made those who control the banking system Masters of the world’s governments and people.

Most people believe our society could not progress without a banking system. At the same time, common sense tells us that we must first have money before we have need for a depository or bank to keep our money safe and help us with money exchanges.

The writers of history tell us that first, the people possessed gold, silver and other valuables that they began to take to a bank (goldsmiths) for safekeeping. The banks did not create the gold, silver or other valuables. The people produced these raw resources of the earth and called them wealth. Gold and Silver bullion is only produced when people labor to extract those raw resource from the earth. We must never forget that all new and value-added wealth is created by working people.

From the time the Europeans started to come to what is now call America, the people have had a shortage of money. History tells us that in the early days the people used many different things as money: Tobacco leaves, furs, shot balls, wampum, currencies from several different countries, silver and silver coins from the Spanish Colonies called Spanish milled dollars.

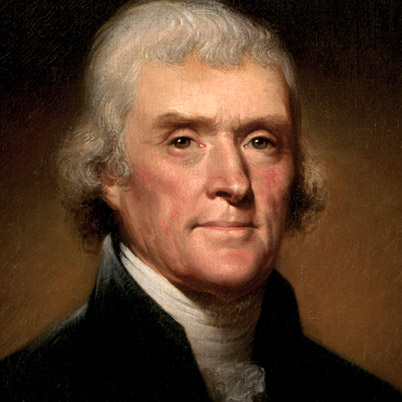

Thomas Jefferson believed that the Spanish milled dollars were the most widely used coins in early America. Under Jefferson’s leadership, the Continental Congress adopted the dollar as the money unit for America.

Thomas Jefferson believed that the Spanish milled dollars were the most widely used coins in early America. Under Jefferson’s leadership, the Continental Congress adopted the dollar as the money unit for America.

Our American Constitution was designed to secure Liberty for the People. That was the reason the war for Independence was fought. One of the duties of the new Government was to ‘monetize’ (turn into money) the People’s production. In 1792, the Coinage Act established a mint to do this by stamping the people’s silver and gold into coined money Free of Expense. It was called Free Coinage. No loans, no un-payable debt, no banks and no inflation were required for commerce to take place. Labor produced production was required before money could be created. The people by their ability to find and mine gold and silver determined how much money there would be. These principles would have provided Americans with a debt-free and interest-free medium-of-exchange based upon and ‘representing’ their production. It would have secured Liberty and Freedom for the People. Debt-free ‘monetization’ of the people’s production is the only monetary principle that assures Liberty.

Why didn’t this system work? Why don’t we have it today? The answer is a simple one. There was not enough gold and silver and never has been. At the time of passage of the 1792 Coinage Act there was not a silver or gold mine in the States United. There was a real shortage of coined money. The bankers of Europe, working through Hamilton, had already taken advantage of this shortage and, in 1791, convinced President Washington and the Congressmen of the new nation that the answer to the shortage of coined money was to start a central bank that would create money as a promise to pay gold or silver.

To this day, the people have never understood the difference between having the real gold and silver (which put money into circulation as earned income) and having a note promising to pay gold or silver (which put money into circulation as interest-bearing debt). Not liking to carry the heavy metal, people gladly accepted and used the notes. To this day, the people have not understood that change in the principle by which money comes into circulation. This ignorance is the cause of all the monetary problems, contention and hardship that we have today.

Under the monetary principle of Debt-free monetization or wealth, the people get the benefit of owning the production they produce and the benefit of owning, not owing, the money they earn as payment for their production.

When the Peoples’ production is ‘monetized’ for their benefit; the People are always FREE and enjoy Liberty. The more wealth the people produce, the more the economy grows with no inflation and no mandatory, enslaving debt to the government, the banking system or any king. The money supply maintains balance with the growth of the population and its production.

Most people who write about the ‘money problem’ do not seem to understand these basic principles of wealth creation and prosperity. They don’t seem to see or understand the actual problems created because of our current debt-credit monetary system.

Their solutions are:

• Reform the banking system

• Interest free loans

• Changes the origination of the loans. Create all money as loans under the government instead of the Federal Reserve Fractional reserve banking system. This solves nothing.

• Sequester

• Austerity

They believe that borrowing all our money without paying interest would solve the problems and that money must be created before we can have production and engage in commerce! (Remember the ant hill?) They believe the commonly taught nonsense that we must go into debt to get money to produce and that producing money without an increase in debt is highly inflationary! Or, they believe that cuts, tax increases, hardship and sacrifice will make the debt will go away and solve the monetary problems. Not understanding if they just got rid of the debt and didn’t change the money system they would also destroy the money supply and create more problems.

Under the principles of the 1792 Coinage Act someone had to produce before money could be produced. Most of us were taught that goods and services should be produced or delivered before payment is made. In other words, most of us know that we should work before we get paid. However, that knowledge seems to be forgotten when we go to the bank and get a loan. The numbers (money) are produced as the bank’s promise to produce later. The borrower gets the make believe money when he signs a promissory note promising to perform in the future. When the production is done first and the money supply is increased as a payment to pay for the production there is no inflation! The money supply increases in balance with productivity gains. There are no Interest charges to artificially drive up the costs of production, when the money supply increases as a payment.

The Constitution for the United States reads, “We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic tranquility, provide for the common defense, Promote the general welfare and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America”

Are we in financial bondage if we have to borrow all of our money even if it is interest free? YES! Is this in the spirit of Freedom? NO! Do you truly believe that you can be free when you must owe your soul to the company store? The answer is clearly NO! You can’t be free and we are not Free people!

“A monetary system can exist without a banking system but a banking system cannot exist without a monetary system.”

When you have the opportunity to read proposals seeking monetary reform we ask that you carefully scrutinize them. Some popular proposals are:

1) The Monetary Reform Act

2) Social Credit

3) Sovereignty

4) Truth in Money

5) Positive Money

6) American Monetary Institute

7) Modern Money Theory

8) Peter G. Peterson Foundation/David Walker

9) Von Mises Institute

Do they offer true reform of our money system or only reform of the banking system and a change of who we owe?

The only real solution is to monetize the production of the people as wealth to the people with debt to no one. The United States Constitution clearly states that is the duty of our Federal Government to do so.